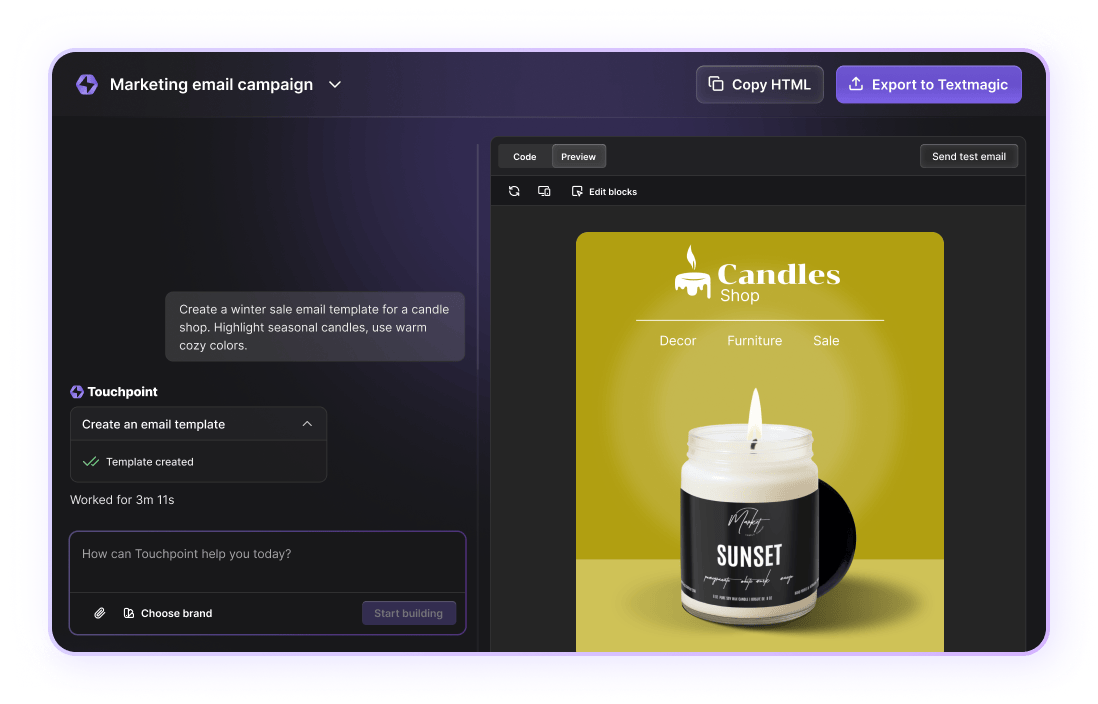

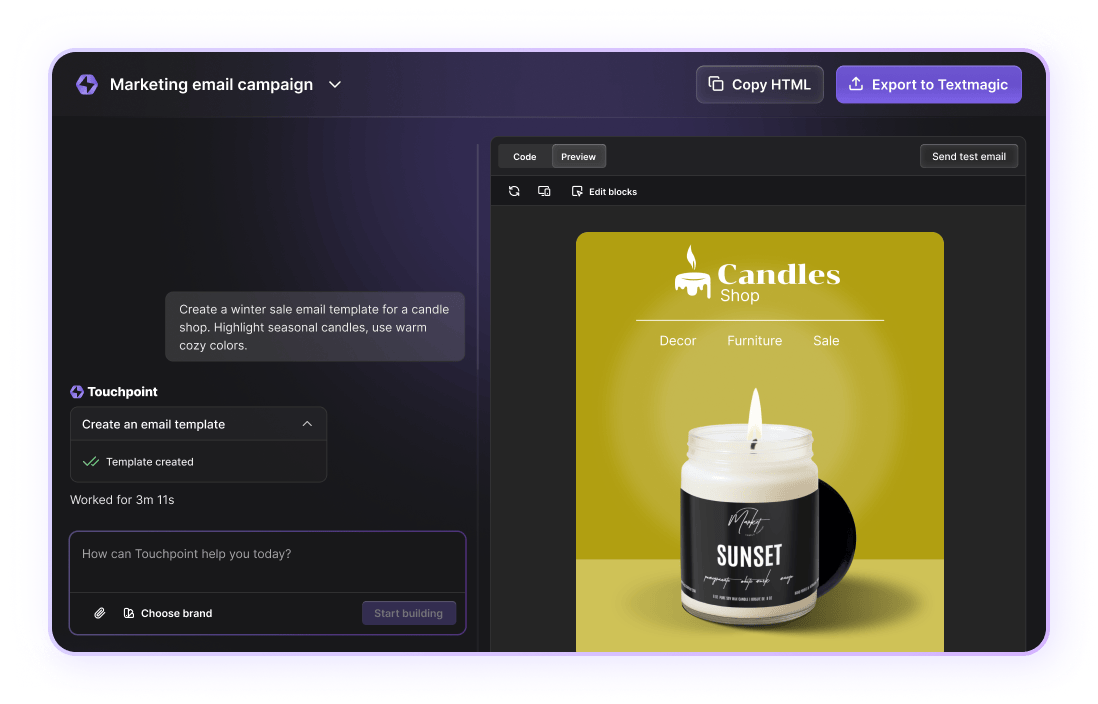

AI email template builder

Create professional newsletters and marketing emails in seconds. Just describe your idea, and our AI email generator builds a stunning, brand-ready template for you. No design skills or coding required.

Try Touchpoint now

Create professional newsletters and marketing emails in seconds. Just describe your idea, and our AI email generator builds a stunning, brand-ready template for you. No design skills or coding required.

Try Touchpoint now

CLV (customer lifetime value) is vital for understanding how much revenue you can expect from one client. Our CLV calculator helps you accurately determine lifetime value by considering ARPA (average revenue per account), MRR (monthly recurring revenue), and churn rate.

Here's how you can calculate average CLV with our tool:

Step #1 - Input the number of active paying customer accounts that your business has. This number should be placed in the "Number of Customers" field.

Step #2 - Next, establish how much money your customers pay your business every month. This amount is known as the total Monthly Recurring Revenue (MRR) and should be typed into the appropriate field of our CLV calculator.

Step #3 - Enter the total average dollar value your business earns for each account per month.

Step #4 - The next step is to determine your company's gross margin. This amount represents the portion of each dollar of revenue that your company retains as profit. Gross margin is expressed as a percentage. You can enter it into the fourth field of the customer lifetime value calculator.

Step #5 - Lastly, determine your company's churn rate. This is the total amount of customers that leave your business each month. If you are unsure of your churn percentage, you can quickly determine it using our churn rate calculator. Once you have this percentage, enter it into the fifth and final field of the CLV calculator.

Click the green "Calculate" button once all your data has been entered into the fields. Within a few moments, the CLV calculator will determine the average lifetime value of your customers. This value can later be used to determine the average profit margin you can make from one customer account within their lifetime with your company.

You can download and save the results on your computer or device or request a shareable link to your CLV information.

Our customer lifetime value calculation tool is helpful for any business looking to determine the average net profit earned from each customer. Not only is this calculator fast and straightforward to use, but it provides vital insight into your company's average customer lifespan and its effect on your bottom line.

To devise a proper marketing or advertising campaign and to perform budget planning, you must understand how much your customers are currently spending and how much they will spend in the future. Without this data, all of your planning will be done blindly.

Other benefits of calculating CLV include:

Better decision-making by helping your marketing team reduce CAC (customer acquisition cost) and time spent pursuing low-value users;

Useful for calculating average purchase frequency and customer spends;

Determining the health of your business and planning short and long-term KPIs;

Insights into your customer retention rate strategies.

Measuring the financial impact of all marketing initiatives.

We created this tool as a free method for businesses to gain information about their customer base. We know how complicated it is to measure different business metrics like CLV, conversion rates, and more. As a growing SaaS, we want to help other companies stay on top of their most important metrics.

Customer lifetime value (also known as CLV) is the total average profit margin that you can expect to earn from one customer over their entire lifetime or business relationship with your company.

This figure is important because the higher the CLV, the better your company's profits. Finding ways to increase your CLV will allow your company to increase revenue from existing customers.

Customer lifetime value (CLV) and lifetime value (LTV) are the same things when speaking in this context. However, when people refer to LTV outside the business context, they speak of a business metric called the loan to value. To avoid any miscommunication, it is better to use the term CLV.

It is crucial that a business measure more than just its profitability. Metrics such as channel entrances, acquisition, and CLV are also vital. Adding CLV to a business's standard reports can help predict long-term performance or identify specific groups of customers who make purchases more frequently.

There are many different ways that you can improve customer lifetime value, such as:

Improving customer loyalty;

Increasing the average order size;

Increasing the average order frequency;

Creating personalized email or other marketing campaigns targeting high-value clients.

Explore our range of complimentary tools designed to enhance your experience.

Grow revenue and improve engagement rates by sending personalized, action-driven texts to your customers, staff, and suppliers.